Anil Ambani Faces Major Setback as SEBI Bans Him from Securities Market

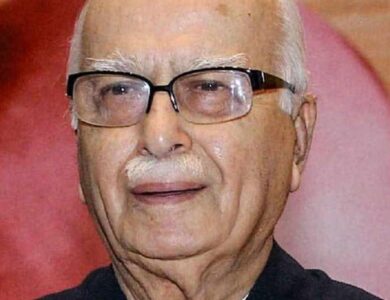

Anil Ambani, a prominent figure in Indian business and chairman of the Reliance Group, was recently barred from the securities market for five years and fined approximately $3 million by the Securities and Exchange Board of India (SEBI) on charges related to the diversion of funds.

Ambani responded by stating that he is reviewing the order and will take the necessary legal steps in response.

Once among the world’s wealthiest individuals—ranked sixth in 2008—Ambani’s fortunes have since taken a dramatic downturn, culminating in his declaration of bankruptcy in a UK court in 2020.

Here’s a timeline of key events that have contributed to the downfall of his business empire:

2005: The Ambani family reaches an agreement to divide the Reliance conglomerate between Mukesh Ambani, now Asia’s richest man, and his brother Anil Ambani. Anil takes control of companies such as Reliance Communications and Reliance Infrastructure, while Mukesh oversees Reliance Industries, which has significant operations in the oil and gas sector.

2014-2017: Within a decade, Anil Ambani’s power and infrastructure companies begin to accumulate substantial debt. Around the same time, Reliance Naval and Engineering, one of his other ventures, faces insolvency proceedings.

2017-2019: Reliance Communications secures a loan of 2.5 billion rupees from Dena Bank, which remains unpaid for years, prompting the sale of telecom assets valued at 240 billion rupees in an attempt to reduce the company’s debt. During this period, Ambani faces multiple legal challenges, including potential imprisonment for failing to pay Ericsson AB and lawsuits from Chinese banks over loan defaults. In addition, PwC resigns as the auditor for Reliance Capital after receiving unsatisfactory responses to its queries regarding the company’s 2019 financial accounts. Reliance Communications eventually seeks bankruptcy protection to address its financial burdens.

August 2020: The Delhi High Court halts insolvency proceedings against Anil Ambani related to a 12 billion rupee personal guarantee he provided to the State Bank of India for loans extended to his companies.

November 2021: The Reserve Bank of India initiates bankruptcy proceedings against Reliance Capital.

February 2022: In an interim order, SEBI prohibits Anil Ambani and other senior management from holding directorial positions or associating with any listed entity or market intermediary, pending further investigation into allegations of fund diversion.

March 2022: Anil Ambani resigns from the boards of Reliance Infrastructure and Reliance Power.

August 23, 2024: SEBI officially bans Anil Ambani from the securities market for 5 years due to fund diversion charges.